Prepare For The End of Covid Student Loan Forbearance

Understanding Covid Student Loan Forbearance

As the Covid-19 pandemic swept across the nation, student loan borrowers faced unprecedented challenges. In response, the government introduced student loan forbearance, offering relief to millions of borrowers burdened by their financial obligations.

However, as the end of Covid student loan forbearance approaches, it's crucial to be prepared and informed about the next steps. Social Service of America, a leading organization in the philanthropy sector, is here to guide you through this transition and provide valuable resources.

Why is Transitioning from Covid Student Loan Forbearance Important?

Transitioning from Covid student loan forbearance requires careful planning and understanding of the implications it may have on your financial situation. Failing to prepare can result in unexpected financial burdens.

At Social Service of America, we recognize the significance of this transition and are dedicated to ensuring that you have the information and support needed to make informed decisions.

Key Steps to Prepare for the End of Covid Student Loan Forbearance

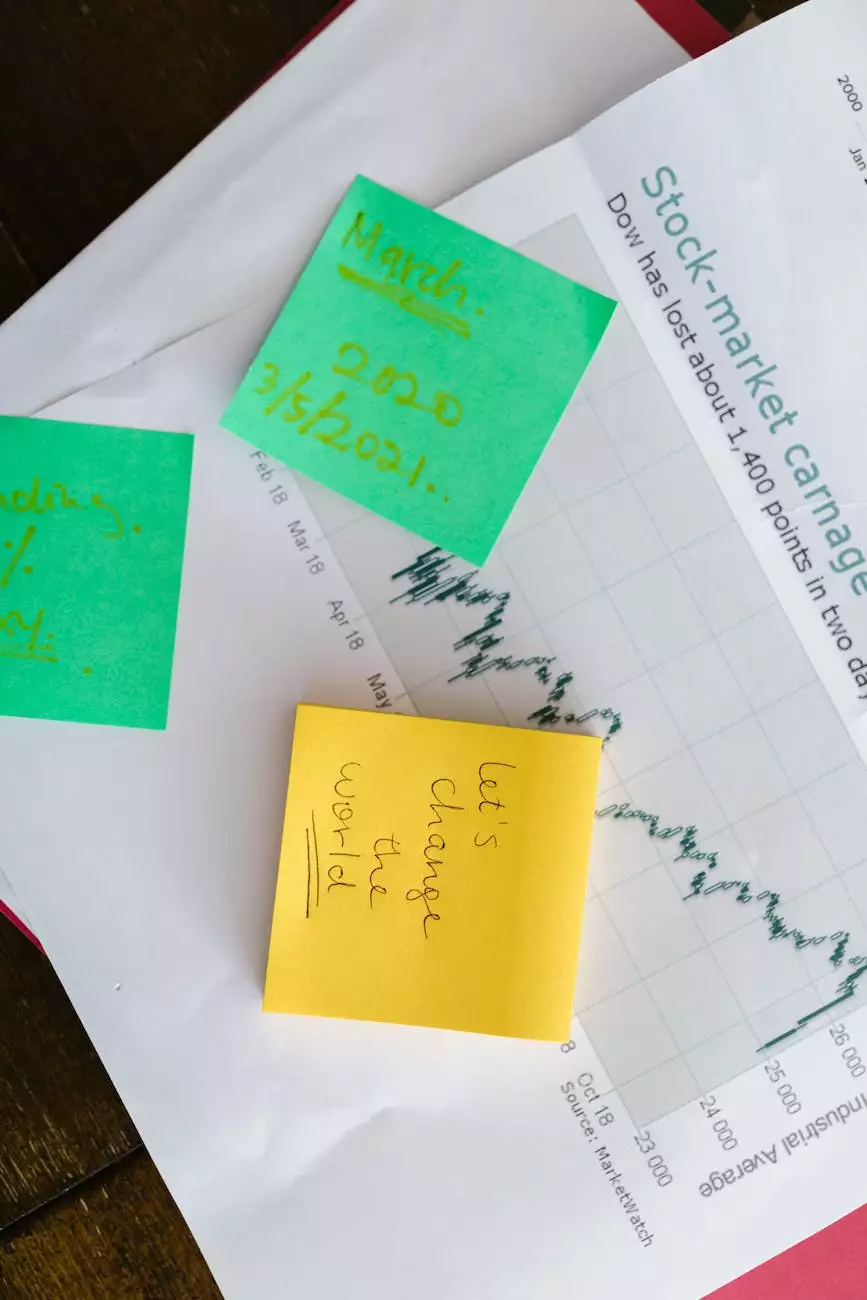

- Evaluate Your Loan Repayment Options: Take the time to assess the available repayment plans and understand the potential impact they may have on your budget. Utilize online calculators and resources to compare different options.

- Create a Post-Forbearance Budget: As the end of Covid student loan forbearance approaches, reevaluating your budget is essential. Account for the resumption of student loan payments and adjust your financial plan accordingly.

- Explore Loan Forgiveness Opportunities: Familiarize yourself with loan forgiveness programs and eligibility criteria. Determine if you qualify for any federal or state-specific forgiveness initiatives that can provide relief from student loan debt.

- Seek Professional Guidance: If you find the transition overwhelming, consider consulting with financial advisors specializing in student loan management. They can provide tailored guidance based on your unique circumstances.

Useful Strategies to Stay on Top of Your Student Loan Repayments

Once your Covid forbearance ends and you resume student loan payments, it's important to stay proactive in managing your repayment obligations. Here are some effective strategies:

- Create a Repayment Calendar: Keep track of payment due dates by creating a calendar or setting reminders. This ensures you never miss a payment and helps you stay organized.

- Set Up Automatic Payments: Enroll in automatic payment options provided by your loan servicer. This helps prevent missed payments and can even qualify you for interest rate reductions.

- Consider Loan Consolidation: If you have multiple student loans, consolidating them into a single loan can simplify the repayment process. Explore the benefits and potential drawbacks before making a decision.

- Apply Extra Payments Wisely: If you have surplus funds, strategically apply them towards your student loan principal to reduce the overall interest accrued over time.

Access Valuable Resources from Social Service of America

At Social Service of America, we aim to empower individuals with the knowledge and tools necessary to succeed financially. Our organization offers comprehensive resources to help you prepare for the end of Covid student loan forbearance.

Whether you are looking for detailed repayment guides, information on loan forgiveness opportunities, or professional financial advice, Social Service of America is your go-to source.

Conclusion

As we approach the end of Covid student loan forbearance, it's essential to be proactive, well-informed, and prepared. With the guidance and resources provided by Social Service of America, you can navigate this transition smoothly and ensure a solid financial foundation.

Remember, your financial well-being matters, and we are here to support you every step of the way.