How to Respond to a Fraud Alert on Credit & Protect Yourself

Introduction

Welcome to Social Service of America, your trusted source for information and resources in the field of philanthropy and community building. In this article, we will discuss how to effectively respond to a fraud alert on your credit and take necessary steps to protect yourself from identity theft.

Why Fraud Alerts are Important

Fraud alerts play a crucial role in safeguarding your financial well-being. When you suspect fraudulent activities on your credit accounts, it is essential to act swiftly to minimize potential damage. By placing a fraud alert, you signal credit bureaus and creditors to perform additional verification processes before granting credit in your name, providing an extra layer of protection against identity theft.

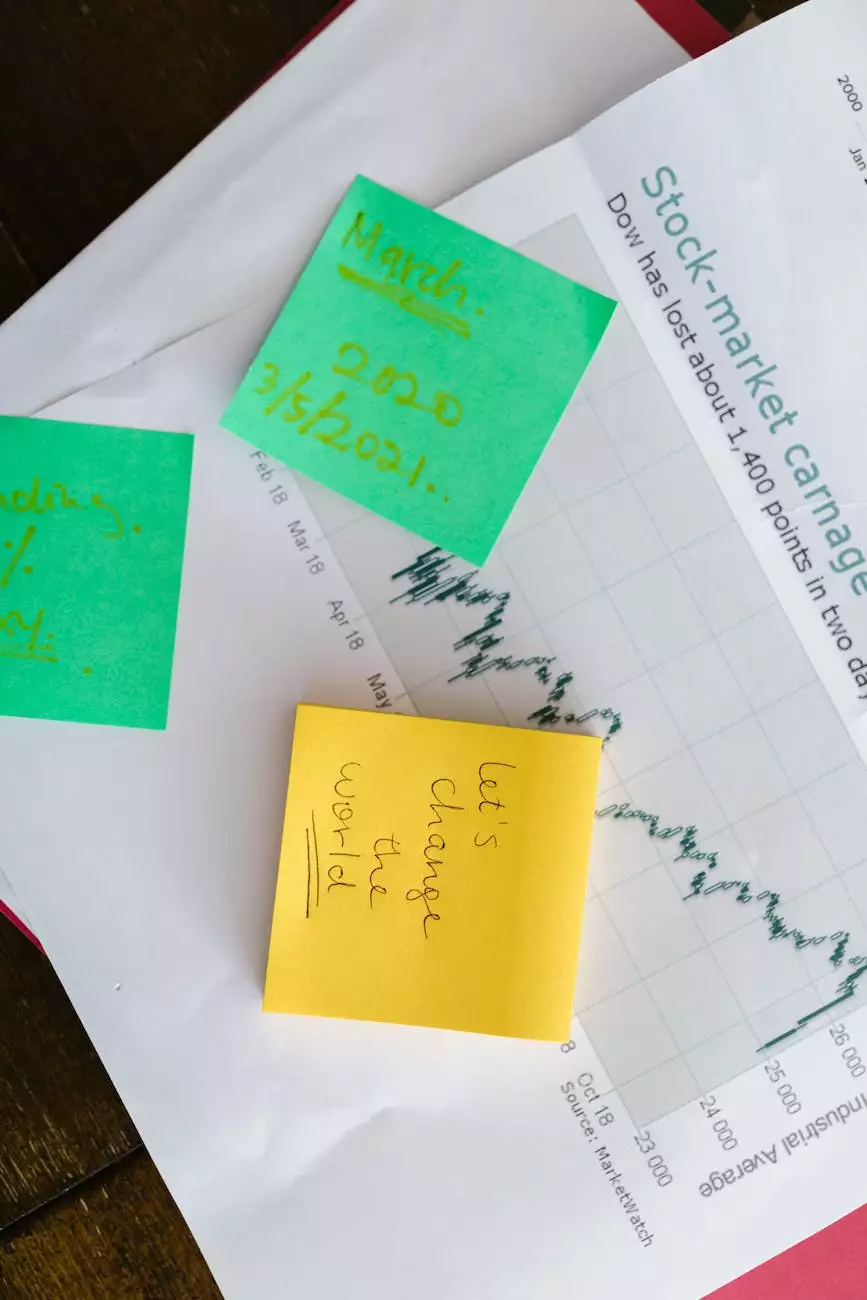

Identification of Fraudulent Activity

Identifying fraudulent activity on your credit accounts is the first step in responding to a fraud alert. Keep a close eye on your credit reports, bank statements, and credit card transactions for any suspicious or unauthorized entries. Unusual account activity, unfamiliar charges, or notifications from creditors or credit bureaus can be red flags that indicate potential fraud.

Responding to a Fraud Alert

1. Contacting Credit Bureaus

As soon as you identify fraudulent activity, contact the major credit bureaus - Experian, TransUnion, and Equifax. Inform them about the suspected fraud and request a fraud alert to be placed on your credit reports. This initial step is vital to ensure that the bureaus are aware of the potential risk and can take necessary measures to protect your credit information.

2. Freezing Your Credit

In addition to placing a fraud alert, consider freezing your credit with the credit bureaus. A credit freeze restricts access to your credit reports, making it extremely difficult for fraudsters to open new accounts or apply for credit in your name. Be sure to follow the specific procedures outlined by each credit bureau to initiate a credit freeze.

3. Reviewing Your Credit Reports

Obtain copies of your credit reports from all three major credit bureaus and carefully review them for any suspicious entries or unauthorized accounts. Report any discrepancies immediately to the respective credit bureau and follow their instructions for further action. Regularly monitoring your credit reports is crucial to staying vigilant against potential fraud.

4. Notifying Financial Institutions

Contact your bank, credit card issuers, and other financial institutions where you hold accounts or credit lines. Inform them about the fraudulent activity and provide any evidence or documentation you have gathered. They can help you investigate the matter, protect your existing accounts, and assist with recovery procedures.

5. Filing a Police Report

Report the fraud to your local police department and file an official police report. This step creates a documented record of the incident and may be required by financial institutions, credit bureaus, or government agencies that assist in fraud investigations. Provide the police with any relevant information and copies of supporting documents.

6. Utilizing Identity Theft Protection Services

Consider enrolling in an identity theft protection service that offers advanced monitoring, proactive alerts, and professional assistance in case of identity theft. These services can provide an extra layer of security, helping you navigate the aftermath of a fraud incident and mitigate potential damages.

Preventing Future Fraud

While responding to a fraud alert is essential, proactively safeguarding your personal and financial information is equally important. Implement the following preventive measures to reduce the risk of future fraud:

- Regularly monitor your credit reports and financial accounts for any unusual activity.

- Securely store personal information and sensitive documents, such as social security cards and bank statements.

- Use strong, unique passwords for your online accounts and enable multi-factor authentication when available.

- Be cautious of phishing attempts and avoid clicking on suspicious links or providing personal information to unknown sources.

- Shred or destroy old financial documents before discarding them.

- Keep your computer and mobile devices protected with up-to-date antivirus software and security patches.

- Regularly update your software and operating systems to address any vulnerabilities.

- Consider purchasing identity theft insurance to provide additional financial protection.

Conclusion

Protecting yourself from fraud and identity theft is crucial in today's digital age. By following the steps outlined above and implementing preventive measures, you can respond effectively to fraud alerts and minimize the risk of future incidents. At Social Service of America, our mission is to provide the resources and knowledge necessary for individuals and communities to thrive. Stay informed, stay vigilant, and take control of your financial well-being.