The Difference Between Saving and Not Spending

Making your Money Count

At Social Service of America, we believe in the power of smart financial management and philanthropy. That's why we're here to help you understand the difference between saving and not spending, and how you can make your money count towards a better future.

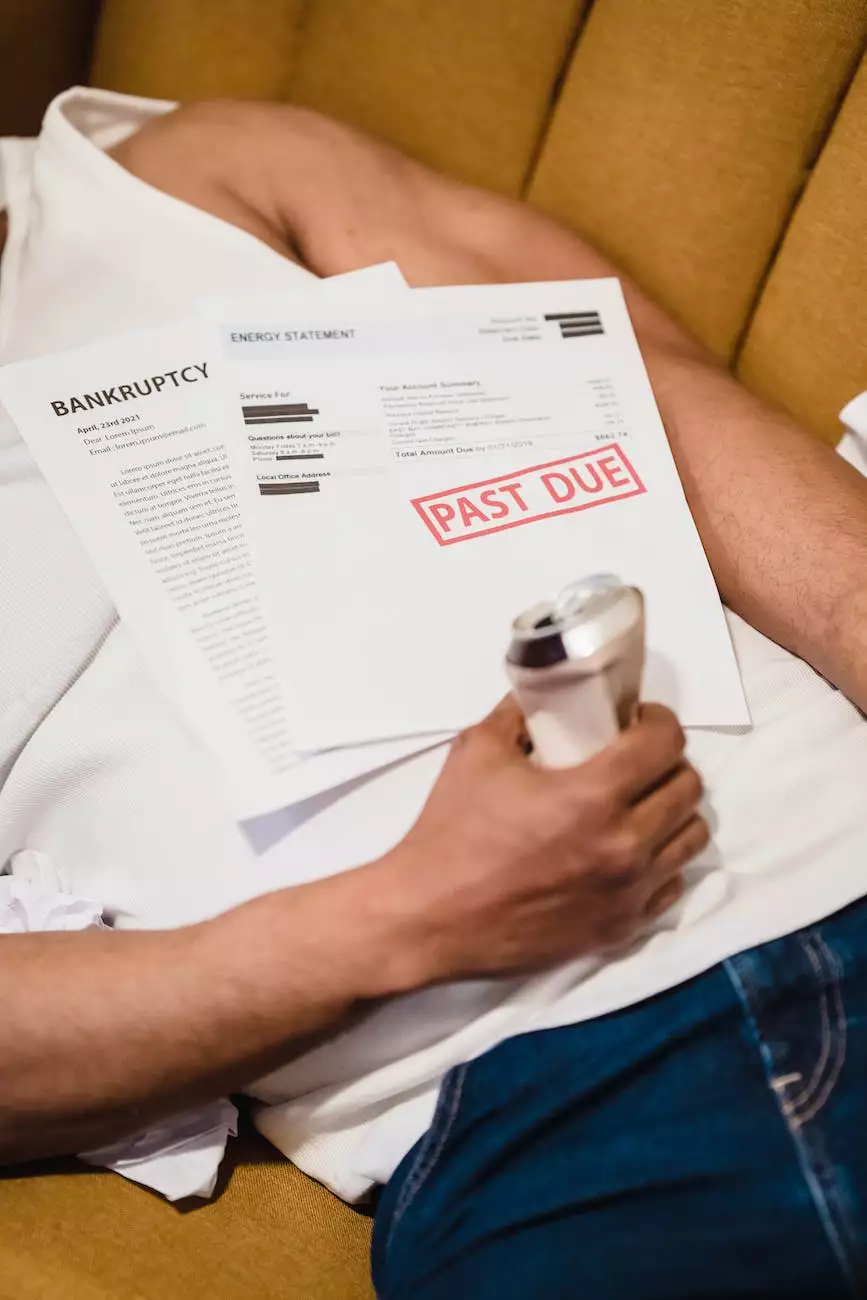

Understanding Saving and Not Spending

Many people mistakenly use the terms "saving" and "not spending" interchangeably, but there is a subtle yet significant distinction between the two. Saving refers to setting aside a portion of your income or resources for the future, with the goal of building wealth or achieving specific financial goals. On the other hand, not spending involves a conscious decision to refrain from unnecessary or impulsive purchases, redirecting those funds towards something more meaningful or impactful.

The Power of Saving

Saving money allows you to create a financial safety net, enabling you to handle unexpected expenses, invest in your long-term goals, or contribute towards a cause you care about. It provides you with a sense of security and freedom, empowering you to chase your dreams and seek out opportunities without the constant worry of financial instability.

The Impact of Not Spending

Not spending, however, takes saving one step further by actively redirecting the funds towards endeavors that serve a greater purpose. By resisting unnecessary purchases and evaluating the true value of each expenditure, you can make a positive impact on both your life and society. Not spending allows you to prioritize your values, contribute to charitable initiatives, and support organizations working towards positive change.

Striking the Balance

Striking a balance between saving and not spending is key to achieving financial stability while making a difference in the world. It's about being intentional with your financial choices, allocating funds towards your financial goals, and allocating resources towards charitable initiatives or philanthropic causes that align with your values.

Our Approach at Social Service of America

At Social Service of America, we are committed to empowering individuals with the knowledge and tools to manage their finances effectively while giving back to their communities. Through our community and society philanthropy programs, we aim to create a positive and lasting impact by encouraging sustainable financial practices and supporting initiatives that address social issues.

Financial Education and Resources

We provide comprehensive financial education and resources to help you understand the importance of saving, managing debt, and making informed financial decisions. Armed with this knowledge, you can develop a solid financial plan that includes both saving for the future and redirecting funds towards meaningful endeavors.

Philanthropic Initiatives

Through our philanthropic initiatives, we facilitate connections and partnerships between individuals and charitable organizations, making it easier for you to contribute to causes you care about. By leveraging our platform, you can actively engage in impactful philanthropy and play a part in creating positive social change.

Becoming a Catalyst for Change

By understanding the difference between saving and not spending, and by adopting a balanced approach that combines smart financial management with philanthropic activities, you can become a catalyst for change. Together, we can build stronger communities, support meaningful causes, and drive sustainable social progress.

Conclusion

Discover the power of saving and not spending with Social Service of America. Embrace financial responsibility while making a positive impact on society. Join us in creating a better future for all.