Convincing your partner to break their bad money habits

Introduction

At Social Service of America, we understand the importance of healthy financial habits within relationships. Dealing with a partner's bad money habits can be challenging, but with the right approach and effective communication, it is possible to create positive change.

Understanding the Impact of Bad Money Habits

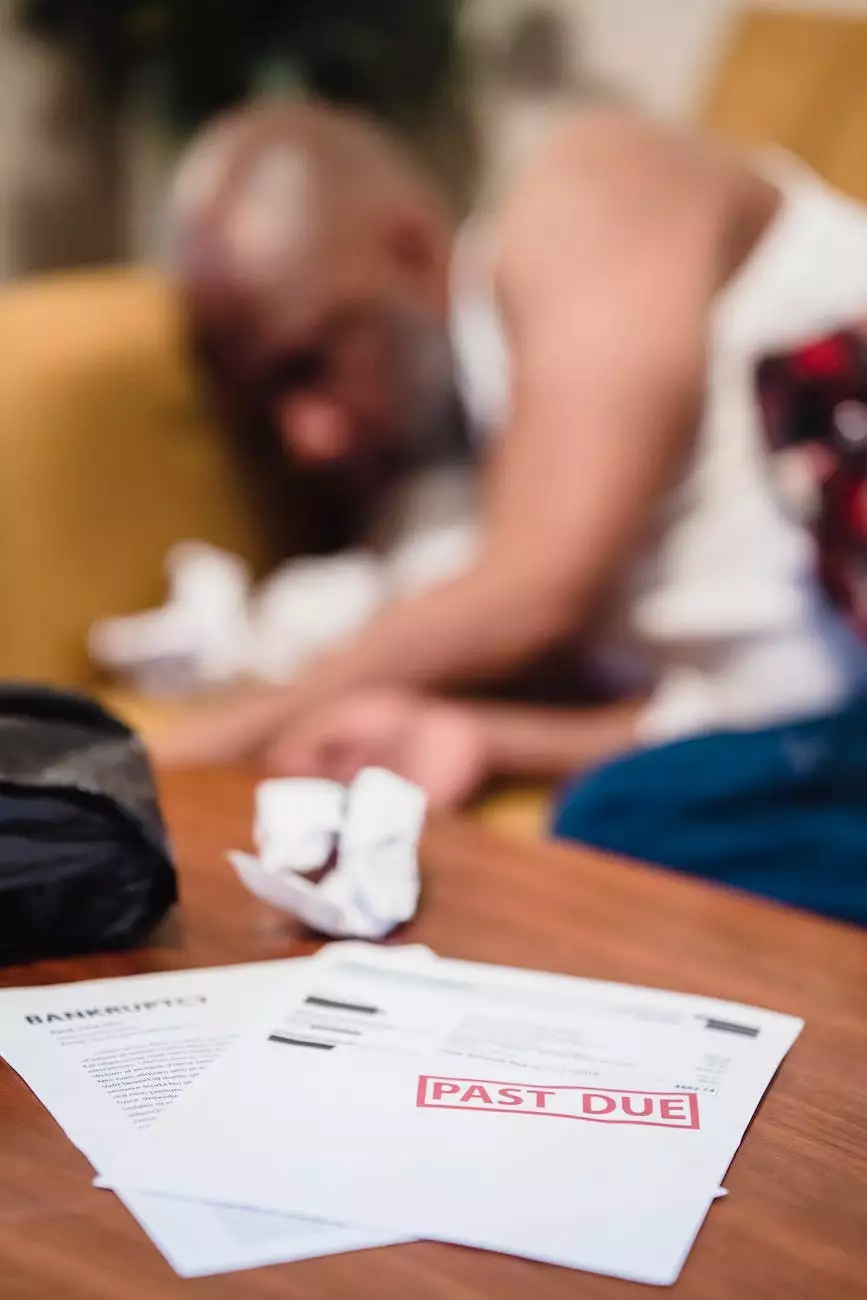

Bad money habits can have a significant impact on individuals and relationships. Whether it's overspending, impulse buying, or failing to save, these habits can lead to financial stress, arguments, and even result in long-term financial difficulties.

Financial Stress

Financial stress can strain relationships, leading to increased tension, arguments, and a loss of trust. It is essential to address these habits to alleviate financial burden and create a healthier environment for both partners.

Long-Term Financial Difficulties

Continuing with bad money habits can have severe consequences, including debt accumulation, inability to reach financial goals, and limited opportunities for future growth. Recognizing the long-term impact of these habits is crucial for initiating change.

Steps to Convincing Your Partner to Break Bad Money Habits

1. Open and Honest Communication

Start by fostering an open and honest conversation with your partner about their money habits. Let them know your concerns and the impact these habits have on your relationship and future plans.

2. Show Empathy and Understanding

Approach the discussion with empathy and understanding. Avoid blaming or criticizing your partner, as this can lead to defensiveness. Instead, express concern and a desire to work together towards a solution.

3. Identify the Root Causes

Work together to identify the underlying reasons for your partner's bad money habits. It could be related to emotions, past experiences, or simply a lack of financial education. Understanding the root causes will help you develop targeted strategies for change.

4. Set Realistic Goals

Establishing realistic goals is essential for breaking bad money habits. Discuss short-term and long-term financial objectives with your partner and create a plan that aligns with your shared vision for the future.

5. Create a Budget

A budget is a powerful tool for managing finances and breaking bad money habits. Together with your partner, develop a comprehensive budget plan that considers all income sources, expenses, and savings goals.

6. Offer Support and Encouragement

Breaking bad money habits can be challenging, so it's crucial to offer support and encouragement along the way. Celebrate small victories, acknowledge progress, and be patient throughout the process.

7. Seek Professional Help

If the bad money habits persist, consider seeking assistance from a financial counselor or advisor. Professional guidance can provide valuable insights and strategies tailored to your specific situation.

Celebrate Financial Growth Together

As your partner begins to break their bad money habits, celebrate their growth and newfound financial responsibility. Remember that building healthy financial habits is a continuous journey, and maintaining open communication is key.

Conclusion

Convincing your partner to break their bad money habits is a challenging but worthwhile endeavor. By fostering open communication, understanding the root causes, and implementing practical strategies, you can create a positive financial future together. At Social Service of America, we are committed to assisting individuals and communities in improving their financial well-being.

About Social Service of America

Social Service of America is a leading organization in the field of philanthropy. Our mission is to provide support, resources, and guidance to individuals and communities in need. Through various programs and initiatives, we strive to make a positive impact on society's most pressing challenges.

Contact Us

For more information about our services and how we can assist you, please visit our website http://socialserviceofamerica.org or contact our friendly team at [email protected].